Leading Benefits of Selecting the Best Payroll Services in Singapore for Your Organization

Leading Benefits of Selecting the Best Payroll Services in Singapore for Your Organization

Blog Article

Browsing the Complexities of Pay-roll Conformity: How Specialist Services Ensure Regulatory Adherence

Expert services specializing in pay-roll conformity offer a sign of assistance via this maze of intricacies, providing a shield against potential violations and fines. By delegating the ins and outs of pay-roll conformity to these experts, services can browse the governing surface with confidence and precision, safeguarding their procedures and making certain economic honesty.

Value of Regulative Compliance

Guaranteeing regulatory conformity is critical for specialist solutions organizations to preserve operational integrity and reduce lawful dangers. Specialist solutions companies operate in an intricate landscape where laws and laws are regularly advancing, making it important for them to remain abreast of any kind of changes and ensure their practices remain certified.

Knowledge in Tax Obligation Laws

Efficiency in navigating intricate tax obligation laws is indispensable for specialist solutions organizations to preserve economic compliance and support honest standards. Professional services companies must possess a deep understanding of tax codes, reductions, debts, and conformity demands to ensure accurate economic coverage and tax filing.

Tracking Labor Laws Updates

Staying educated concerning the most recent updates in labor regulations is vital for professional solutions companies to make certain compliance and mitigate dangers. As labor laws are subject to frequent adjustments at the government, state, and neighborhood degrees, following these advancements is important to stay clear of potential fines or lawful issues - Best payroll services in Singapore. Expert services firms should develop durable mechanisms to keep track of labor laws updates effectively

One means for organizations to remain notified is by subscribing to e-newsletters or notifies from appropriate federal government firms, market organizations, or lawful experts concentrating on labor law. These resources can give timely notices about brand-new regulations, modifications, or court rulings that may influence payroll conformity.

Additionally, professional services companies can take advantage of pay-roll software application options that use automatic updates to make sure that their systems are aligned with the most recent labor legislations. Routine training sessions read for human resources and payroll personnel on current lawful adjustments can also boost awareness and understanding within the organization.

Decreasing Compliance Risks

Furthermore, staying informed concerning regulative modifications is important for lessening conformity dangers. Specialist solutions companies should continually keep an eye on updates to labor regulations, tax obligation laws, and coverage demands. This positive method makes sure that payroll procedures continue to be certified with the current lawful standards.

Furthermore, buying employee training on compliance issues can boost understanding reference and minimize errors. By enlightening personnel on appropriate laws, regulations, and finest methods, organizations can foster a society of conformity and reduce the possibility of violations.

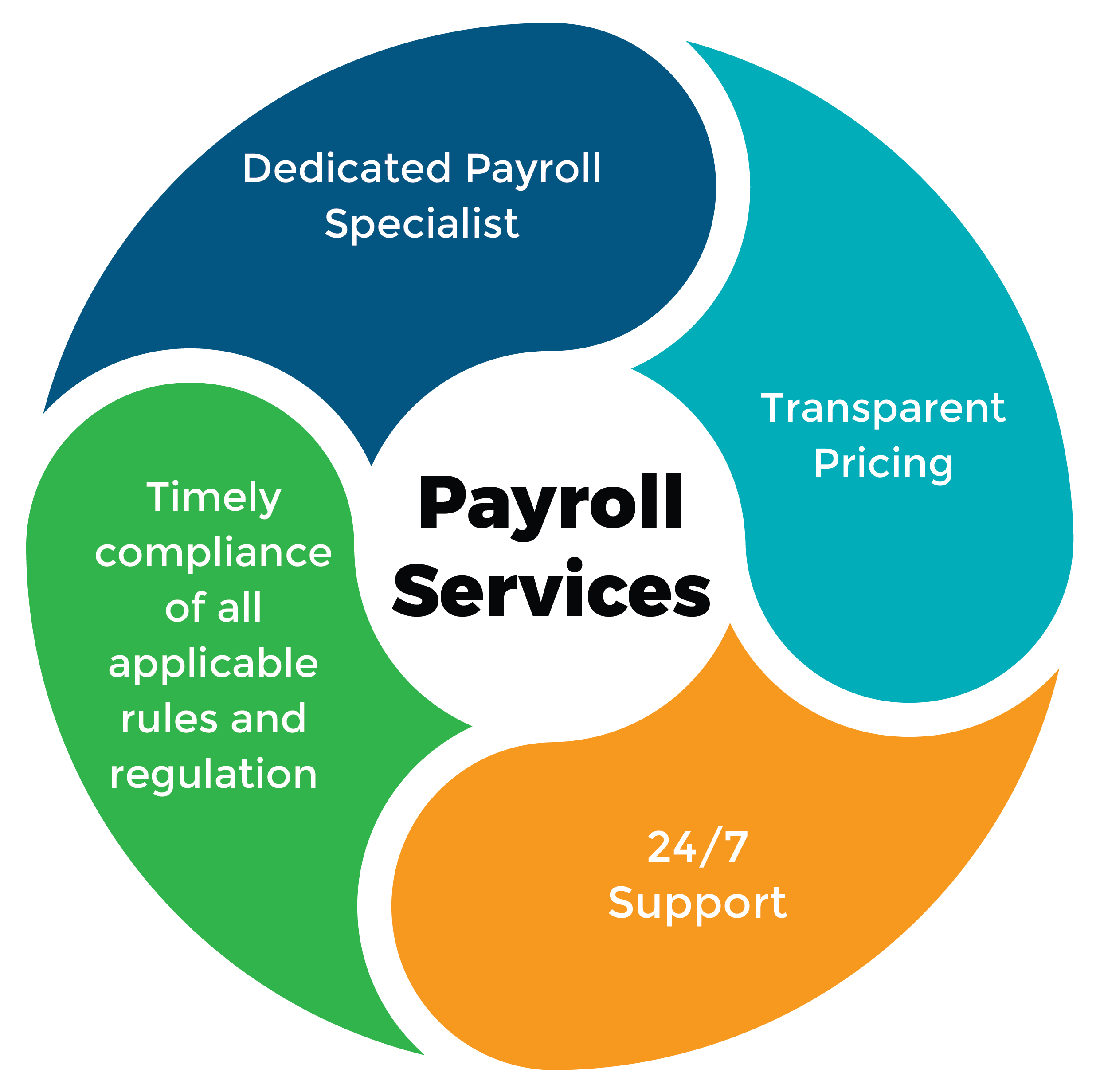

Advantages of Specialist Pay-roll Solutions

Navigating payroll conformity for specialist services organizations can be substantially streamlined with the utilization of expert payroll solutions, using a range of advantages that boost effectiveness and precision in taking care of payroll procedures. Specialist payroll solution providers are skilled in the details of pay-roll policies and can make sure conformity with ever-changing regulations and tax obligation demands.

An additional benefit is the automation and integration abilities that expert pay-roll services use. By automating regular jobs such as calculating tax obligations, earnings, and deductions, companies can simplify their pay-roll procedures and decrease the possibility for errors. Assimilation with various other look at here now systems, such as accounting software, further enhances efficiency by eliminating the need for manual data entry and reconciliations.

Additionally, professional payroll solutions provide secure information management and discretion. They employ robust security measures to shield delicate worker info, decreasing the threat of information violations and guaranteeing compliance with information defense laws. Overall, the advantages of professional payroll solutions add to set you back savings, precision, and satisfaction for professional solutions companies.

Conclusion

Finally, specialist payroll services play an essential duty in ensuring regulative adherence and decreasing conformity risks for organizations. With their expertise in tax obligation policies and continuous monitoring of labor legislations updates, they provide valuable assistance in navigating the intricacies of payroll conformity. By delegating pay-roll obligations to specialist services, businesses can concentrate on their core operations while preserving lawful compliance in their pay-roll processes.

To alleviate compliance dangers efficiently in specialist services organizations, thorough audits of payroll procedures and documentation are critical.Navigating pay-roll conformity for expert solutions companies can be considerably structured through the use of specialist payroll services, supplying a range of benefits that boost efficiency and accuracy in handling pay-roll procedures. Professional payroll solution providers are well-versed in the ins and outs of pay-roll regulations and can guarantee conformity with ever-changing regulations and tax obligation requirements. Generally, the advantages of specialist pay-roll services contribute to cost savings, accuracy, and peace of mind for expert solutions companies.

By entrusting payroll obligations to expert services, services can concentrate on their core operations while maintaining legal conformity in their pay-roll processes.

Report this page